To understand where gold is now, we need to take a quick look back at fairly recent history. Richard Nixon pulled the US Dollar off the gold standard in 1971 when it was priced at about $40 per ounce. The reason he did that was because many foreign trading partners of the US were starting to demand payment in gold instead of the Greenback. In the press conference he said it was a temporary solution to protect the dollar from shorts-sellers, but the fact of the matter was that too many dollars had been created by the Fed Reserve for the amount of gold on account. At that point, private investors in the US couldn’t legally purchase gold as FDR had issued an executive order in 1933 for all citizens to turn in their gold – and that executive order was still in place. The removal of gold backing of the dollar removed the guardrails to keep the government from overspending. The US dollar truly became a fiat currency being borrowed into existence with nothing tangible backing it. The great monetary expansion had begun…

Then on New Year’s Eve 1974, President Ford issued an executive order rescinding the gold ownership ban (Congress had passed a bi-partisan bill re-legalizing gold for investors a few months prior.) The price of gold averaged about $170 in January of 1975 as investors bid up the price with their first purchases in 40+ years. There was fear of inflation and gold was the go-to asset back then to retain purchasing power.

Gold had an eye-popping rally in the late 1970’s launching up to $850 in 1980. At that time Federal Reserve chairman Paul Volcker raised interest rates as high as 19% to fight inflation and gold sold off for two decades – finally putting its low in at about $265 in late 2000.

The subsequent rally in the US Dollar price of gold off that low was quite impressive as it traded higher 11 years in a row! (2001-2011) There were some wicked selloffs during that time as well when speculators got over leveraged, but the demand for gold was fierce. Then from 2012 to 2020 gold traded sideways with some big down moves but finally traded over $2000 per ounce.

Since the Covid crisis of 2020, central bankers around the globe have conjured up a blizzard of new currency units of every flavor and at the same time have gobbled up thousands of tons of gold for their own portfolios. The recent run-up over $3500 per ounce has been fueled by fear of international trade wars and “de-dollarization” of different trading groups. Gold has pulled back a bit, but the million-dollar question is – should investors still buy it at these levels? Here’s the million-dollar answer…YES!

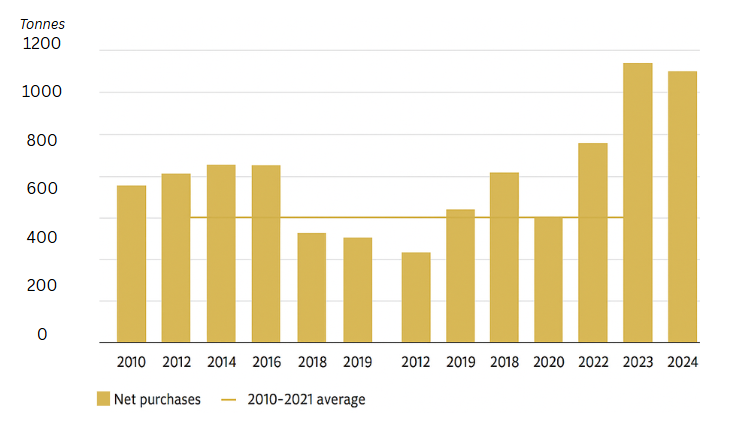

An historic look at demand-driven rallies in ANY market will educate you quickly that NO ONE knows how high “high” is. Meaning – gold could go a lot higher from here. No one can perfectly time market movements, the simple reality is that conditions are still bullish gold! The demand-driven description that we are using for this rally is because central banks and individual investors alike continue to acquire more gold. We can’t tell you when that slows down. The percentage of central bank assets that are in gold is still historically low and the percentage of private investors’ portfolios comprised of gold is probably still below 1%. All investors should own some gold and the demand side of the equation remains strong. Take a look at central bank net buying of gold over the last few years…

Sources: Metals Focus, Refinitiv GFMS, World Gold Council

Obviously, no one knows when this central bank buying slows down. Considering this demand which is more than 20% of total world production and a NUMBER of other factors, we continue to suggest acquiring more gold.

Here is the key – get a yield on your gold assets!! Warren Buffett famously described gold as a pet rock because it was a “non-performing” asset. There was no yield on holding it for individual investors. In fact, most people pay storage fees or mutual fund fees for their ownership of gold. However, now individual investors can lease or loan their gold out and earn a return on their assets. Our GoldRush Yield Fund is on the cutting edge of this change in the investing world. The marketplace of gold – and silver – returning to the monetary system as a capital asset being leased and loaned is growing exponentially! The anxiety of paying too much for an asset that has been rallying is mitigated by getting a consistent yield when you purchase! Think about it in terms of ounces rather than dollars. Interest payments increase the number of ounces you own – the dollar value of those ounces can be calculated later.

Reach out to us to learn more on getting a yield on your gold holdings!

Regards and good investing,

Greyson Geiler