There are plenty of financial doomsdayers out there that write ad nauseam about the imminent demise of the US dollar and how everyone needs to pile all their assets into Bitcoin or gold or some foreign currency as a life raft to weather the pending financial/economic Armageddon. This week we are not piling on and adding to the panic. We are going to talk about building assets in an alternative structure that is a new way to even out the risk in our financial planning. However, first we would like to start with why the US dollar IS NOT imminently going to zero…

Understand that the monetary system that the entire world uses was built by the United States post-World War II. The US dollar was then “as good as gold” as it was backed by and could be redeemed for gold. Although that system has been altered along the way – Nixon ended the gold-backing in 1971- much of the same system is still intact. The IMF and the World Bank that were created at the same Bretton Woods meeting post WWII have continued to heavily influence world finances. The US dollar remains the world’s reserve currency. Let’s look a little further into what that means… The dollar is the official currency of 11 countries other than the US, mostly in the Americas and the Caribbean. It is also the quasi-official currency of many countries that have a set exchange rate pegged to the US dollar. It is accepted in many countries as payment where there is no pegged interest rate including many countries in Southeast Asia. It is the medium of exchange for approximately 80% of international trading outside of the Eurozone where the Euro is dominant. US dollar denominated assets make up almost 60% of the world’s central bank reserves – according to the Atlantic Council. In daily currency trades, the US dollar is part of 90% of the transactions. Perhaps most importantly, the US treasury bonds have turned into the dominant asset class in which central bankers around the world hold assets. It is a US dollar dominated world – PERIOD. Everything else – even the Euro – is completely overshadowed by the US $. Right now, there are many people talking about the BRIC (Brazil, Russia, India, China) countries putting together a gold-backed currency – THEY JUST CAN’T TELL YOU WHEN IT WILL ACTUALLY HAPPEN This is wishful thinking at best. These countries don’t trust one another except when they are all resisting the US worldwide monetary bullying. They won’t be able to agree on a depository for gold that could establish a delivery mechanism for a gold-backed currency. They have all built paper currencies that have crumbled within recent memory, and they won’t be able to put together a solid new currency as a collective. But do keep in mind that they are talking about it and will continue making efforts to evolve away from the US $ for international transactions which over time will be detrimental to us.

Our monetary system does have some serious flaws – both in its design and in its execution – that we continually review in this weekly post. America – actually, the entire world – has a Federal Reserve or corresponding central bank that is behaving recklessly stimulating too much then contracting too much engineering repeated boom/busts. Now they are changing rules on the fly and shooting from the hip to bail out banks such as Silicon Valley Bank or carving up a Signature Bank and giving the good parts to Chase. US leaders have forced the Russians out of the international trade system of the US Dollar, and they are forced to find alternatives. On the fiscal side, the financial profligacy of our government is onto absurd levels with budget deficits and total debt rocketing to the moon. Although interest rates are settling down a bit, they are still higher than they have been since before the 2008 meltdown and these increased rates are being applied to a debt load today which dwarfs what we had in 2008. We have an ageing population – a student loan disaster that to this point has only been brushed under the rug and a litany of other problems. No, the US $ isn’t going to zero tomorrow, but we should be looking for an on-ramp for alternatives that can mitigate some of our US dollar risk. The Fed will at some point have no choice but to come back to the table printing more currency units to try to fill the voids they have created in the world’s financial system over the last few decades.

So, what are some alternatives to the US Dollar? Again – we are looking for avenues to diversify and effectively create a hedge for some of our holdings – not looking for a total divestment of the US $. Historically people have talked about other currencies – such as the British Pound or the Japanese Yen. Without rehashing details, we are not fans of looking for another paper currency for the long term. The whole world is dependent on the US dollar and if it falls apart, serious damage will be sustained by the entirety of the world economy. Other paper currencies may be a successful short-term trade, but they are certainly not a long-term alternative.

What about crypto currencies? We have written repeatedly about cryptos and the efforts of world central banks to create their own. That would be a nightmare of totalitarian control, and we can’t stress enough how dangerous a central bank-controlled crypto would be. As far as Bitcoin and those types of cryptos, we are relatively agnostic. However, the price volatility alone in Bitcoin keeps it from being the center of any monetary system or a viable alternative for a significant percentage of your US $ based net worth. That being said, speculate with smaller sums if you choose – just be careful because the BlackRock and Vanguard-type players in the financial world are taking control of the crypto space. That runs counter to the original philosophical goal of the Crypto World, and we worry that the future of crypto may be volatile…

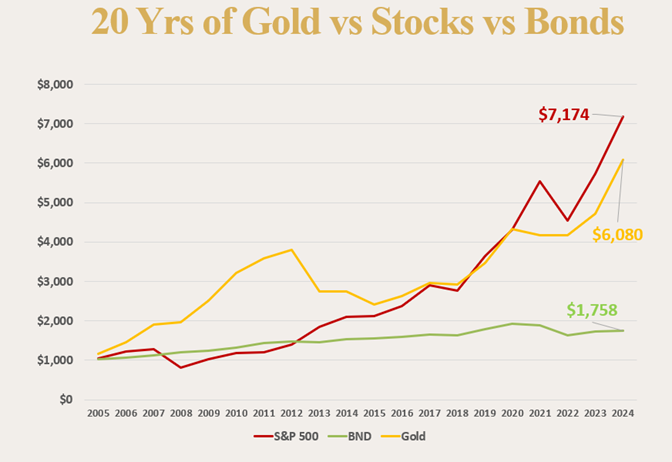

An obvious alternative to the current monetary system is gold considering that is money and has been for more than 5000 years. We frequently talk about gold and encourage the purchasing of it. However, when contemplating the building of a significant portion of our portfolio denominated in gold, there are some concerns that need to be addressed. One of the most frequently asked questions when talking about adding gold to a portfolio is “where should we store it.” The answer to that is certainly not a safe deposit box, so some end up paying for professional storage, which is generally about .25%-.75% annually. That gets annoying and adds up over time. Some prefer to “own” gold through the ETFs on the stock exchanges and that can incur fees as well. Past the storage, some investors are repelled by the doomsdayers and don’t subscribe to the immediate panic. Especially since a lot of doomsdayer guys have been vocal for a couple decades and disaster just hasn’t happened yet. There is also the issue with what type of metal to buy – gold coins that are rare and have numismatic value or just bullion? And what about the liquidity? How does one buy and sell? These are challenges when considering diversifying some of your assets out of the dollar, but let’s take a historical perspective on the long-term financial viability of investing in gold before we worry about some of these details. Here is a hypothetical example of owning gold for the last 20 years. We will compare it to owning the total return of the S&P 500 (dividends included.) We will also add a bond fund that represents a hypothetical holding of US dollars and getting a low-risk yield on those dollars. The results are a little surprising…

$1,000 starting 20 years ago in 2005 in the S&P 500 has grown to $7,174. That’s a pretty impressive return. Not surprisingly, that same $1,000 in our hypothetical bond portfolio would have only grown to $1,758. Interest rates were that miserable for most of the last 20 years. The surprising part is gold kept pace with the stocks remarkably well. For an asset that has, historically zigged when stocks zagged, that is a nice performance for the overall portfolio. For some people this is all they need to see. They want to own some gold, find undisclosed and safe storage for themselves and simply keep it as a rainy-day guarantee in case our monetary system hits the rocks. We understand and encourage that strategy – and for some the discussion can stop there feeling that at least a minimal alternative plan has been covered… Others want to see if there is a way to take things a step further to take advantage of the strength of gold. Of course, gold mining stocks can be a levered-up way to take advantage of gold prices going higher. During the run up of gold in the late seventies some investors raked in fortunes as some of the mining stocks rallied many multiples more than the rally in gold prices. We are not against that strategy; however, we are convinced it is a difficult and dangerous one. Mining is a tough long-term investment, and we look at mining stock ownership as largely a shorter-term trade. There are also ETFs (essentially mutual funds) available through a stock trading account that are gold-mining focused.

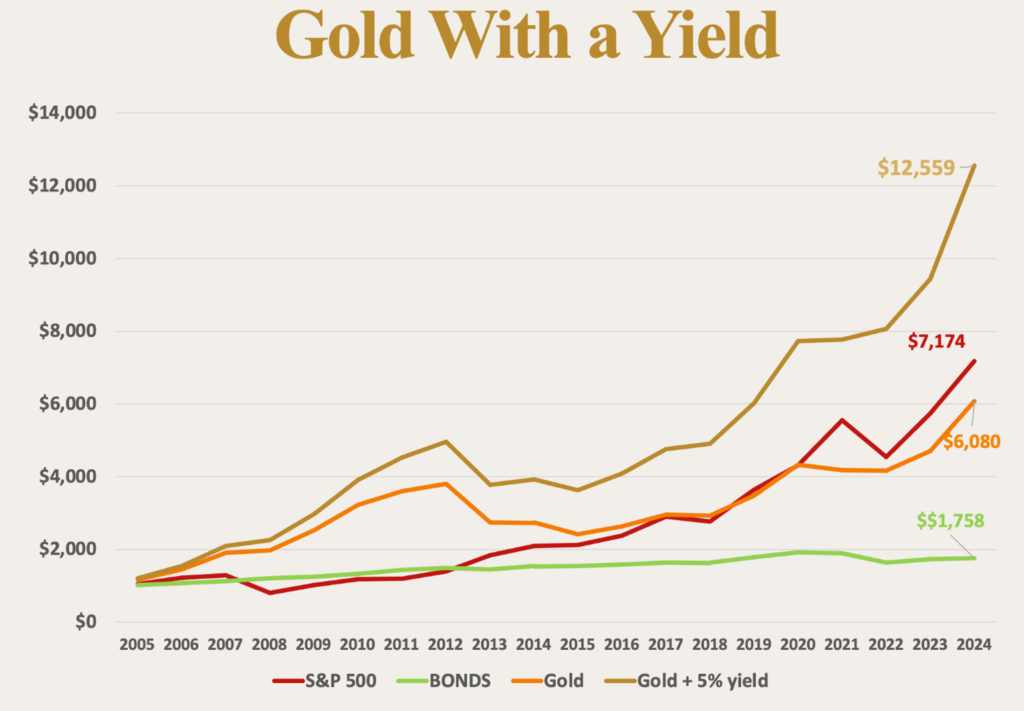

What if there were a way to earn a rate of return on gold much like the bonds we just looked at? What if there were a consistent rate of return on our gold – in gold terms. Take a look at the same comparison chart we just looked at, but with the added assumption that we earned 5% in gold every year on our gold holdings. Not wild interest rate indicating high levels of risk, but just a consistent return in gold on gold… How many US dollars’ worth of gold would we have now?

As you can see, gold with a consistent yield is obviously a compelling concept (somebody call Warren Buffett!!) Gold, with a consistent yield wildly outperformed the S&P 500 over the last 20 years (the chart would be much more dramatic if we had started in the year 2000.) As you can see, the gold-on-gold yield is absurdly better than the dollar-on-dollar yield from the bond world.

Over time gold prices go higher as paper currencies erode in value and if you are getting gold interest on your gold – well, you see the results above. We are not talking about speculative or leveraged positions in gold, but just a consistent 5% yield in gold on gold. But is that available in our financial markets – is it even possible?

There is a growing marketplace of leases and bonds that are denominated in ounces of metal rather than in US dollars or other currencies. Investors deposit gold and silver, and companies borrow the metal for use as capital and pay interest in gold and silver. There are many companies that would rather borrow -and pay interest -in gold and silver terms because they are in businesses that use these metals. This marketplace is booming internationally right now and we at Andorra Capital have created a fund to deploy investments into these metal-based leases and bonds to take advantage of these opportunities. Reach out to us if you would like to learn more.

Regards and good investing!

Greyson Geiler

Market and industry data used in this presentation have been obtained from sources believed to be reliable. However, we have not independently verified such data and make no representation or warranty as to its accuracy or completeness.