Gold has been in the headlines of financial news quite a lot over the last few months because of a historic run that topped out – for now – at about $3500 per ounce. It is about 25% higher in US dollar terms just in 2025 and we see a lot of pontifications about how much higher it is going to go from here. We are obviously heavily invested and involved in gold. However, we look at it differently than just as an asset that is going higher so it must be bought and stored. We are focused on how investing in gold has changed.

Warren Buffett is one of the world’s best-known investors because of an amazing performance track record over many decades. Although his father valued gold from a monetary system perspective because of the limits it inherently puts on central bankers and politicians, Warren wasn’t so fond of gold. He famously likened investing in gold to owning a pet rock. It didn’t produce any earnings or interest or income. Even though gold has historically trended higher in US $ terms, Warren had a point…

Passive income is a big component of creating long-term wealth. Whether investing in stocks for dividend yield, bonds for interest payments or real estate for rental/lease payments, investors rightfully place a big emphasis on consistent income. This compounds the return of an investment which can be drastic as time goes on. When an income stream is the focus, less importance is placed on the market price of an asset – unless you need liquidity being forced to get out of an investment.

Over the last decade investing in gold has been changing – and now it’s ready for the mainstream portfolio. The change is happening because gold leasing and lending is now a rapidly expanding marketplace of borrowers, lenders and investors. The leasing side of marketplace is what we are focusing on today – so let’s take a closer look at what’s going on…

Historically, it was typically big institutions like central banks or bullion banks that would lease their gold out to earn a return on it. This market has been notoriously opaque with no standardization. In many of these “lease” deals, the gold was actually sold, and the proceeds would be invested in interest bearing assets. There would be a promise to return the metal at a later date, but this isn’t a true lease – it is really looks more like a loan. That brings in a lot of counterparty risk and when the price of gold is trending higher the issues can be amplified.

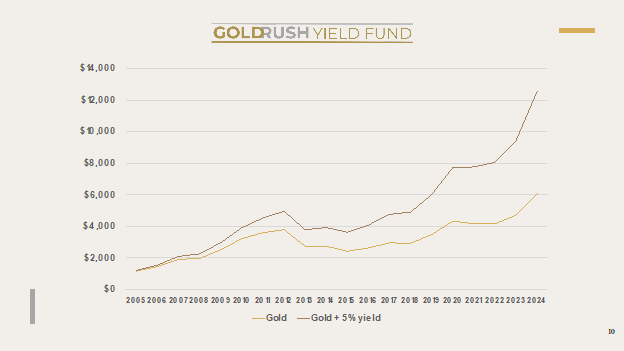

Now, rather than individual institutions leasing out their gold for a return in one-off opaque deals, there is a marketplace where businesses looking to lease gold can find investors with gold ready to lease out for an interest return. This marketplace of gold leases brings transparency and standardization to gold leasing, and it doesn’t only include the large institutions that have historically leased their gold. Our fund is participating in these standardized leases earning a risk-mitigated return on our gold. The interest rates are typically between 2-5% on the leases but they are set by a marketplace of supply and demand rather than dictated by central bankers like so much of our fixed-income world. These are true gold leases where the ownership of the gold stays with the investor – mitigating risk. Take a look at what a compounding 5% interest rate would mean to the dollar value of your gold holdings if you bought $1000 worth of gold 20 years ago.

This is a hypothetical example but comparing the US dollar value of gold holdings over the last 20 years between keeping it in storage vs leasing it out for interest payments is quite compelling. Keep in mind, the interest payments received by leasing gold out is in ounces of gold – not in US dollars. The ounces earned are also appreciating in value over time in US dollar terms. If the interest is continually leased out the compounding is quite impressive. Much like real estate, gold goes higher in US dollar terms. Also, much like real estate, we can now get lease payments from those who want to use our gold.

With the maturing marketplace of gold leases, a whole new world of opportunity opens up for investors. Getting a consistent income return from gold holdings reduces investor anxiety of paying too much for it – such as now after an historic run higher. Estimates from researchers vary, but there is probably about $5 Trillion of gold in bars and coins in private ownership stored around the globe. It has been sitting idle for decades, but now it is moving being deployed as a capital asset -there is an interest rate on gold again! Gold doesn’t have to be viewed as the doomsday asset that protects a portfolio from Armageddon. It can still fill that role, but now it can also be an income producing asset the likes of which even Warren Buffet might take a look at.

Regards and good investing,

Greyson Geiler