The financial markets in the U.S. never stray very far away from the question of what the Federal Reserve is going to do with interest rates and this week is no different. Stock and bond markets are currently pricing in the Fed not raising interest rates until the June meeting.

However, some economic numbers are weakening will likely cause more speculation that interest rates may come down at the next Fed meeting in May. Asset markets (stocks and bonds) have been holding together remarkably well for months now – but some indicators are starting to show some real complacency and too much comfortability in the markets. This is when we look for things that could go wrong and try to find cracks in the dam. If the economy hits large challenges, the Fed will have to lower interest rates in support as they have historically done. Here are some concerns we see going forward that we think could be indicators that the Fed will have to shift…

- The VIX is pinned near five-year lows. This is a volatility or “Fear” indicator and is a calculation of how much insurance fund managers are buying to hedge the downside of their stock portfolios. When this number is low, it indicates people aren’t afraid of the stock market going down. When few people are looking for problems, that’s when they tend to happen – and a big move down in stocks could get the Fed to lower rates early.

- The February PPI (Producer Price Index) report came out much hotter than expected. This means that inflation isn’t going away quietly as quickly as the Fed has indicated they thought it might. Putting the inflation genie back in the bottle is not easy – as history has proven to us – and we don’t imagine that general inflation will revert back down to the 2% target anytime soon. This complicates how the Fed is going to manage the interest rates going forward.

- Government spending is horrific. We complain regularly in this post and we are doing it again today. Projections of budget deficits from the Congressional Budget Office don’t look accurate to us – so we just have to do the math ourselves. Since the beginning of the fiscal year (Oct 1) the U.S. govt debt has increased $1.411 trillion according to the treasury’s own website. The math is easy – double that for the rest of the year and you are at $2.822 trillion. Our economy is $28 trillion – so we are running a 10% budget deficit???? Let’s hope tax receipts are going to change these numbers a bit in the next few months because normalizing budget deficits like this is banana republic kind of stuff – not what the stewards of the world’s reserve currency should be doing. Financial markets are being distorted by this reckless spending as well and only time will show us exactly how.

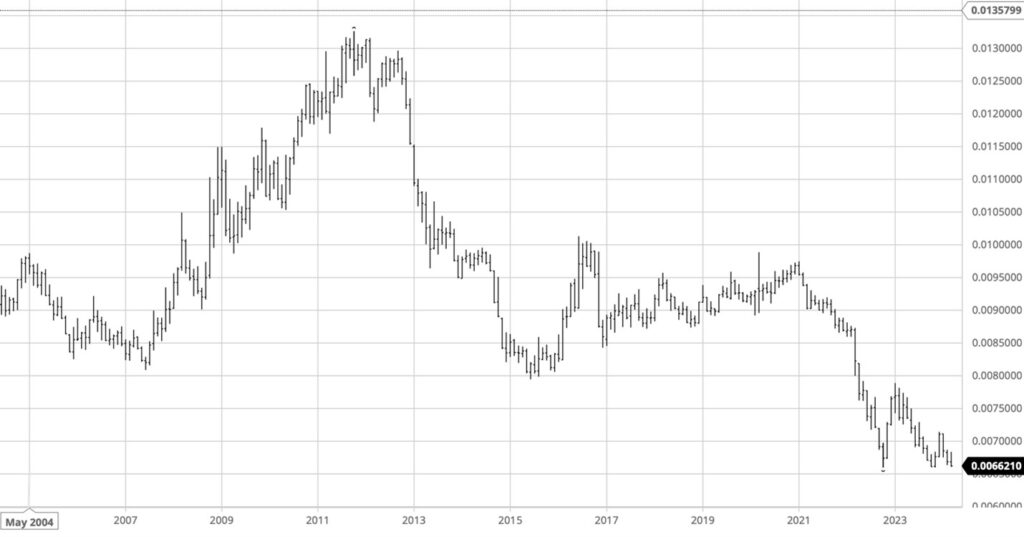

- The Japanese Yen. For going on 10 years, we have talked about the Yen as the proverbial canary in the coal mine of the world’s monetary system. As much as we complain about our Federal Reserve distorting capital markets, the Bank of Japan is WAY worse. They create Yen and buy assets in the Japanese markets to a wildly greater degree than the Fed does in the U.S. Japan is the world’s 4th largest economy by some measures and if the dam breaks and the value of their currency melts down then we need to be on guard. Take a look at a picture of the value of the Japanese Yen vs the U.S. dollar over the last 20 years…

As you can see the Japanese Yen is at the lowest valuation it has been against the U.S. dollar in recent memory. We aren’t afraid of the yen going lower – we are afraid of it completely melting down. This picture suggests the Yen is going lower AND the ingredients are in the pot for a serious meltdown. Let’s hope that doesn’t happen but understand that if it does there will be implications for the whole world’s economy and monetary system. The Fed would likely have to pour huge resources out towards Japan to help hold things together and no one knows how that would look logistically – so stay tuned…

We continually look for potential roadblocks in the world’s economy even though things look quite rosy right now. The economy has held up to higher interest rates much better than most would have expected – which is obviously good news. However, we can’t get complacent and we have to keep on the lookout for the challenges – things that could cause the Fed to lower interest rates sooner and/or more than expected.

Regards and good investing,

Greyson Geiler